Latest Version

Update

May 07, 2024

May 07, 2024

Developer

Kotak Mahindra Bank Ltd.

Kotak Mahindra Bank Ltd.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Report

Report a Problem

Report a Problem

More About Kotak Mobile Banking Betalication

Level-up your finances with new ways to manage your bank account, UPI, and cards.

This app is currently under beta and open only to Kotak customers with either savings/current account or credit card.

New or existing customers, who have other relationships - loans, demat, investment, and insurance - can use the existing Kotak banking app.

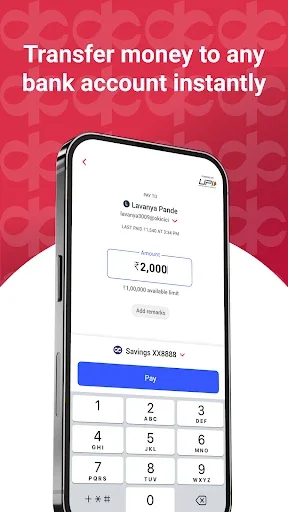

• Payments and Transfers

Make UPI payments (up to ₹1 Lakh) in a flash by scanning any QR code or entering a phone number.

Instantly transfer large amounts (over ₹1 Lakh) using NEFT/RTGS payment options.

Schedule automatic monthly payments to your contacts (domestic help, driver, pocket money, etc).

Receive money directly in your account by sharing your Kotak account’s unique QR code.

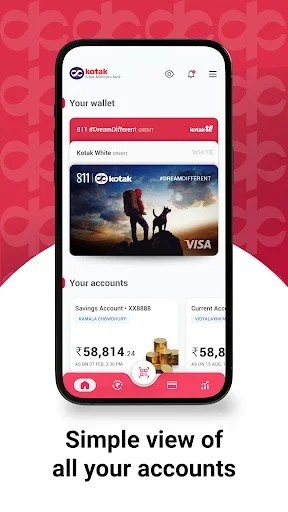

• Unified View

See all your relationships with Kotak together in one dashboard. Savings/current accounts, debit/credit cards, deposits, payments, etc.

Quickly show/hide all balances to maintain your privacy.

• Card Management

Temporarily lock your debit/credit card to maintain security. Disable certain types of transactions whenever required.

Block your cards immediately in case of loss/theft.

See all transactions of your credit card in its current cycle. Review past credit card statements.

• Smarter Investing

Enable ActivMoney to automatically switch your extra account balance into a deposit to earn more interest.

More investment features coming soon.

Your data is safe with Kotak Mahindra Bank. We do not share any information with third parties without your permission.

New or existing customers, who have other relationships - loans, demat, investment, and insurance - can use the existing Kotak banking app.

• Payments and Transfers

Make UPI payments (up to ₹1 Lakh) in a flash by scanning any QR code or entering a phone number.

Instantly transfer large amounts (over ₹1 Lakh) using NEFT/RTGS payment options.

Schedule automatic monthly payments to your contacts (domestic help, driver, pocket money, etc).

Receive money directly in your account by sharing your Kotak account’s unique QR code.

• Unified View

See all your relationships with Kotak together in one dashboard. Savings/current accounts, debit/credit cards, deposits, payments, etc.

Quickly show/hide all balances to maintain your privacy.

• Card Management

Temporarily lock your debit/credit card to maintain security. Disable certain types of transactions whenever required.

Block your cards immediately in case of loss/theft.

See all transactions of your credit card in its current cycle. Review past credit card statements.

• Smarter Investing

Enable ActivMoney to automatically switch your extra account balance into a deposit to earn more interest.

More investment features coming soon.

Your data is safe with Kotak Mahindra Bank. We do not share any information with third parties without your permission.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Good SliceVOODOO

DigitalTreed - Business & Tech 4.6DigitalTreed

Screen Recorder - XRecorderInShot Inc.

Google Chrome: Fast & SecureGoogle LLC

Learn Quran Recite By YourSelfDigitalTreed

Signal Private MessengerSignal Foundation

Klarna | Shop now. Pay later.Klarna Bank AB (publ)

The Lord of the Rings: WarNetease Games Global

Myntra - Fashion Shopping AppMyntra

MuslimSoul : Elite Islamic AppDigitalTreed

More »

Editor's Choice

Hook VPNCharles KEV.

Good SliceVOODOO

Mealime Meal Plans & RecipesMealime Meal Plans Inc

Match Master 3D - Triple MatchFlipped Game Studio

Deen Quiz (Islamic Quiz)Greentech Apps Foundation

Yoga for Kids & Family fitnessGunjanApps Studios

Step Counter - PedometerLeap Fitness Group

Sticker MakerStickify

Cover Fire: Offline ShootingViva Games Studios

Myntra - Fashion Shopping AppMyntra